Biotherapies, or biomedicines, are defined by their mode of production: a biotherapy is produced by a cell or a micro-organism, and is therefore bioproduced. As a result, the challenges of production, safety and analysis of biomedicines are totally different from those of chemically synthesized small molecules.

The emergence of different types of biotherapies has necessitated the introduction of new regulatory frameworks, as well as the creation of an industry sector of its own. In this highly innovative ecosystem, the classification of biologics is constantly evolving: at present, they are divided into four main categories, presented below.

The biopharmaceuticals biotherapeutics

Antibodies & Therapeutic proteins

They include all forms of protein: antibodies, recombinant proteins, peptides, etc.

Vaccines

They can be prophylactic or therapeutic. All types of vaccine (DNA, mRNA, inactivated, oncolytic, etc.) fall into this category.

Advanced therapy medicinal products (ATMPs)

They have emerged more recently than the therapeutic proteins. Cell & gene therapies (e.g. CAR-T cells) and tissue regeneration technology are all part of the ATMPs category.

The latest innovations

Some biotherapies don’t fit into the above three categories, but the therapeutic hope they represent is very strong: for example, microbial therapy, such as antibacterial phage therapy.

A new market, new challenges

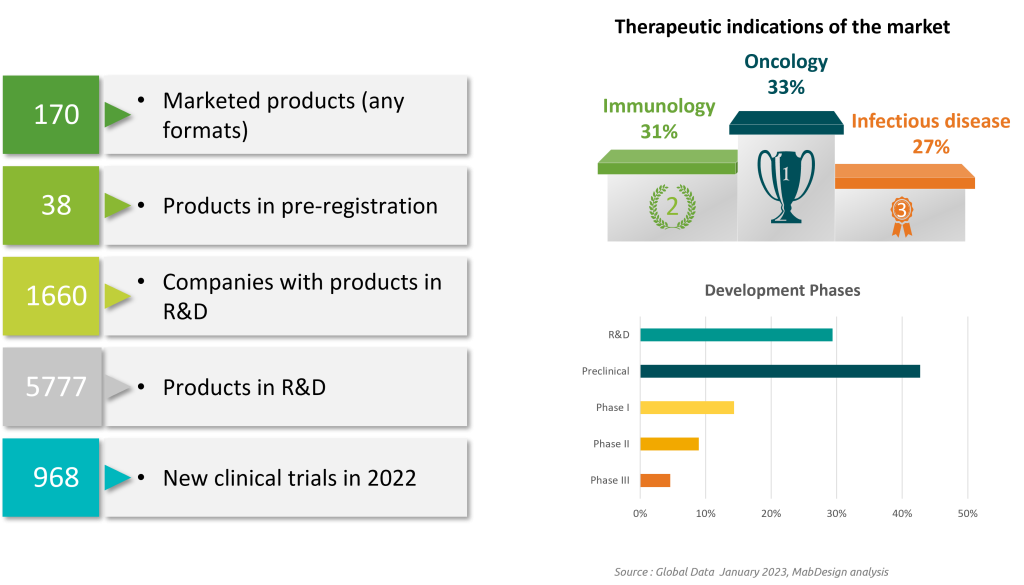

Compared to small chemical molecules, biopharmaceuticals are a relatively recent class of molecules: in 2022, they accounted for just 4% of marketed drugs.

However, the market for biologics is growing rapidly, and is expected to reach $600 billion by 2026. This trend is illustrated by a 64% increase in the number of biopharmaceuticals under development worldwide between 2019 and 2022. In 2023, Biotherapies account for 58% of products under development .

Biologics have opened up new prospects, representing a market of the future and a hope for the treatment of many diseases.

of molecules under development worldwide are biopharmaceuticals

22,809 products

6180 companies

Despite the small number of molecules on the market, biopharmaceuticals account for 32% of drug sales: this high proportion in terms of sales is explained by higher sales prices than for small molecules.

With the coming boom in biopharmaceuticals to treat an ever-increasing number of pathologies, these costs will be unsustainable for healthcare systems. The need to reduce development and production costs for biologics makes biomanufacturing a major priority for the sector.

The French industry

1082 structures in France

Scroll over the regions to see the distribution of stakeholders (%)

As of January 2024, the French industry includes 252 biotech/pharma companies developing biomedicines. These companies are supported by 700 companies offering a full range of services: suppliers, bioanalysis, CRO, CDMO, etc.

The French biologics pipeline is rich, with over 840 products in development, 29% of which are currently in clinical phase. In terms of product types, French biotechs are developing products across the entire spectrum of biotherapeutics, with antibodies and MTIs leading the way.

France's biomedical pipeline: 898 projects and 577 unique products in development

The European industry

Biotechs on the European continent develop 20% of the world’s biotherapies, compared with 43% on the North American continent. The European ecosystem is driven by 4 leading countries: the UK, France, Germany and Switzerland.

Therapeutic antibody and protein formats account for the majority of products under development. As with vaccines and cell therapies, the majority of products are in clinical phases. Gene therapies, a less mature technology accounting for 17% of products in development, are three-quarters in pre-clinical or discovery development.

According to our analysis, France is the 2nd European country in terms of biomedical products under development for over 12 months now, having long been neck-and-neck with Germany and Switzerland.

Biomedicines pipeline in Europe: 5880 projects, and 3778 unique products in development

Biopharmaceuticals in development (top 10 countries, projects)