By mobilizing the patient’s immune system to fight cancer cells, immunotherapy offers new prospects for treating different types of tumor, some of which were previously considered incurable. The immuno-oncology market is experiencing exponential growth, fuelled by scientific and technological advances, massive investment in research and development, and a growing number of regulatory approvals for innovative treatments such as Immune Checkpoint Inhibitors (ICIs),Chimeric Antigen Receptor-T cell (CAR-T) therapies, and therapeutic cancer vaccines.

Classification of biotherapies in oncology

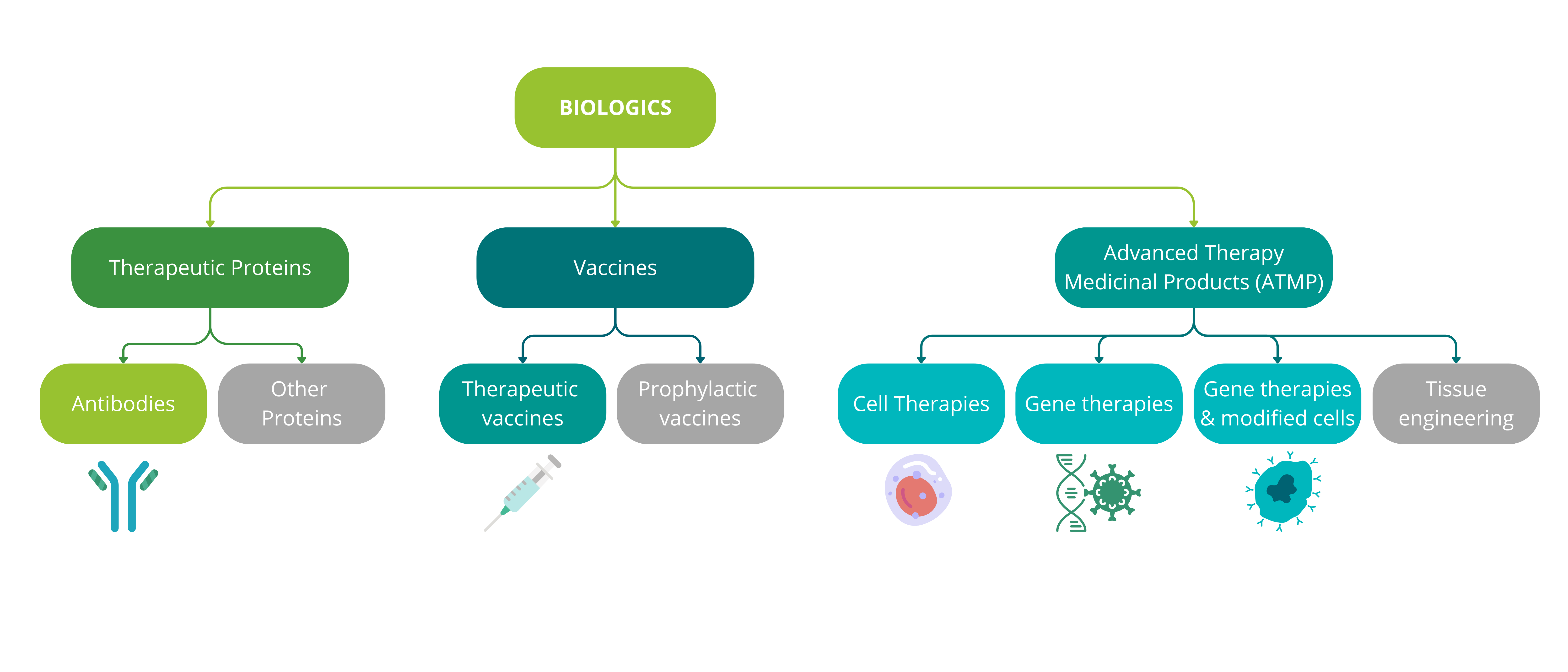

Biotherapies can be divided into three main families: therapeutic proteins, vaccines and advanced therapy medicinal products (ATMPs). To address the market for biotherapies in oncology, we will focus on new, particularly innovative therapeutic approaches: therapeutic antibodies, therapeutic vaccines, in vivo gene therapies, ex vivo gene therapies and cell therapies.

Figure 1: Classification of biological products in the immuno-oncology market analysis

The analysis in this article covers the market for therapeutic antibodies, ATMPs (ex vivo and in vivo gene therapies and cell therapies) and therapeutic vaccines.

Biotherapies are currently a minority on the market compared to small chemical molecules : this is also true for products positioned in oncology, with only 7% of the anti-cancer therapeutic arsenal being biomedicines. There is, however, a wide diversity of therapeutic modalities : vaccines, antibodies, recombinant proteins, cell-based therapies, and so on. Of the products on the market, 502 are unique biologics, the vast majority being therapeutic proteins.

Biomedicines, on the other hand, account for 34% of the rich pipeline, with 10,462 unique biomedicines in development. The majority are once again therapeutic proteins (49%), but ATMPs also account for a significant share of the overall distribution (36%), particularly in vivo gene therapies (26%).

Products on the oncology market

Products under development in oncology

Oncology products in development, by type

Figure 2: Distribution of biologics and small molecules marketed and under development in oncology.

Left – Distribution of marketed oncology products.

Center – Distribution of products under development in oncology.

Right – Focus on the distribution of biological products under development in oncology.

Market dynamics and trends

The immuno-oncology market has been growing for over a decade.

Its expected compound annual growth rate (CAGR) is between 9 and 12% between 2023 and 2030*.

This rapid expansion is fuelled by major deals: big pharma and biotech companies are looking to strengthen their immuno-oncology portfolios, which translates into buyouts and collaborations with start-ups, biotechs or cutting-edge research institutes.

The significant increase in the number of clinical trials and new treatment approvals also reflects the market’s attractiveness and growth potential.

In 2023, 9 new biomedicines were approved in immuno-oncology.

No Data Found

Figure 3: Growth in the number of immuno-oncology deals from 2010 to 2024

Focus on the therapeutic antibodies market

In addition to monoclonal antibodies, innovations such as bispecific antibodies or conjugated antibodies have emerged in recent years, broadening therapeutic options in oncology.

There are currently 108 therapeutic antibodies on the market for oncology indications, including 14 ADCs, 11 bispecifics and 30 immune checkpoint inhibitors.

Market

*excluding biosimilars

Pipeline

*excluding biosimilars

Figure 4: Therapeutic antibodies marketed and under development in oncology

Left – Breakdown by type of therapeutic antibody marketed in oncology, excluding biosimilars.

Right – Breakdown by type of therapeutic antibody under development, excluding biosimilars.

The therapeutic antibody market is booming, and is set to continue growing over the coming years, with annual growth of between 11 and 14% on the global market. Oncology is the leading therapeutic area targeted by therapeutic antibodies, accounting for 40% of the market.

This growth should take the global market to a value of 500 billion dollars by 2030, with particularly strong growth forecast for the bispecific antibody segment.

No Data Found

Figure 5: Sales forecasts for the three types of therapeutic antibody analyzed between 2023 and 2030, in millions of dollars.

Figure 6: Key figures for the therapeutic antibody market in oncology

Focus on the ATMP market

Ex-vivo gene therapies (or genetically modified cell therapies), such as CAR-T cells, are still few on the market: there are currently 17 products commercialized. Oncology is the leading targeted therapeutic area, with 11 products, corresponding to 65% of available therapies. On the other hand, the pipeline is very rich, with over 3,000 ex-vivo gene therapies in development, including 2,508 in oncology, i.e. 82% of the total.

At present, only two in vivo gene therapies are available on the market: gendicine for the treatment of head and neck cancer (marketed in China by Shenzhen SiBiono GeneTech), and adstiladrin for the treatment of superficial bladder cancer (marketed in the USA by Ferring Pharmaceuticals).

Just as ATMPs are taking a growing share of the oncology pipeline, the pipeline of in vivo gene therapies targeting this therapeutic area is substantial, with 265 products in development, including 53 in clinical phase.

Focus on the therapeutic vaccines market

Vaccines, historically prophylactic and focused on infectious diseases, are now positioned as a promising new therapeutic tool in oncology.

These new prospects are reflected in a rich pipeline of 744 projects at various stages of development, but also in a strong momentum illustrated by the entry into the pipeline of 70 new vaccine candidates in 2023, for oncology indications.

It should be noted that 12 of the 13 products on the market are BCG vaccines, licensed by different companies in different countries. The remaining product is a subunit vaccine targeting GP96, available in China, for the treatment of several solid cancers.

Conclusion

Immuno-oncology is based on therapeutic strategies aimed at strengthening and reactivating the body’s immune defenses to fight cancer.

This approach offers therapeutic options that have already demonstrated lasting curative effects, notably with Immune Checkpoint Inhibitors (ICI) or CAR-T cells.

The immuno-oncology market is not weakening, and the field is evolving in terms of R&D and innovation, with, for example, treatment strategies based on product combinations.

This article is an extract from our Immunowatch “immuno-oncology” published in September 2024. You can download it in full by clicking on the link below:

Immunowatch edition 10 – Immuno-oncology

Our other watches are available on the dedicated page :

If you’re looking for support for your projects involving exosomes and extracellular vesicles, don’t hesitate to explore our our range of servicesand contact us for further information.

We’d be delighted to use our expertise to help you achieve your goals!

Sources

- GlobalData April 2024

- GrandViewResearch

- Markets&Markets

- MabDesign data